Smart investments are often linked to good timing. A period of renewed strength in the South African Rand against the US Dollar has created a compelling window of opportunity for South African buyers considering property investment in Mauritius. While exchange rate movements are often viewed as short-term market fluctuations, their impact on offshore property acquisition is immediate and measurable, particularly in markets where assets are priced in US Dollars.

Mauritius luxury residential property is predominantly US Dollar–denominated. When the Rand strengthens, fewer Rands are required to acquire the same asset, reducing the effective purchase price without any change to the listed US Dollar value. This shift directly improves buying power and allows investors to deploy capital more efficiently.

From a financial perspective, a stronger Rand enhances value in several meaningful ways:

- Lower effective acquisition costs in Rand terms

- Improved entry value relative to replacement cost

- Greater flexibility to invest in higher-quality assets without increasing overall capital exposure

To illustrate this effect, below is a simple comparison using average annual USD/ZAR exchange rates across recent years.

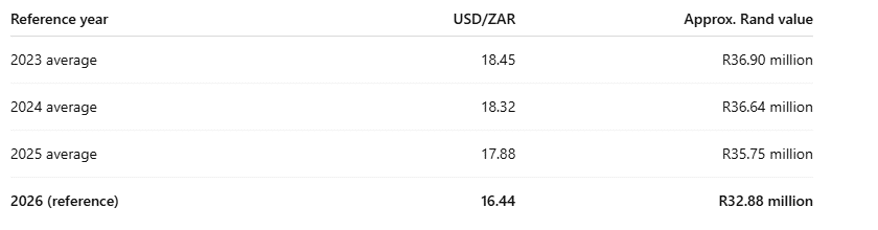

Case study 1: Lifestyle estate apartment – 168 sqm

US Dollar price: USD 800,252

Observation:

Across these periods, the same apartment shows a Rand value variance of approximately R 1.62 million between a weaker and a stronger Rand environment, despite no change in the US Dollar price.

From an investment perspective, this difference can influence:

- Overall capital deployed in Rand terms

- Funds available for upgrades, furnishing, or rental optimisation

- The relative affordability of higher-specification units within the same development

Case study 2: Beachfront penthouse – 394 sqm

US Dollar price: USD 2,000,000

Observation:

At this price point, the Rand value variance across currency environments exceeds R4 million, even though the underlying beachfront asset remains unchanged.

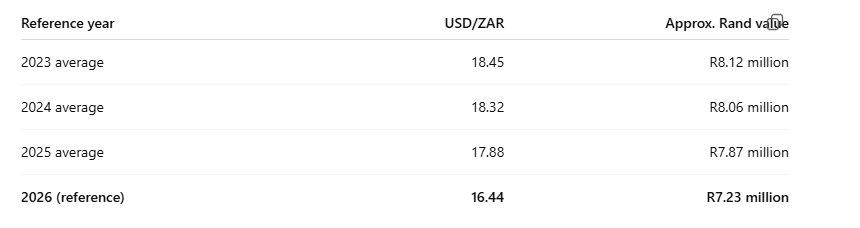

Case study 3: Investment apartment – 130 sqm

US Dollar price: USD 440,000

Observation:

Even at a lower entry price point, currency movements remain highly material. Between a weaker and stronger Rand environment, the same investment apartment reflects a Rand value variance of close to R900,000, with no change to the underlying US Dollar asset.

Mauritius continues to stand out as a preferred offshore destination due to its political stability, transparent legal framework, and well-regulated property market. Foreign buyers benefit from clearly defined ownership structures, secure transaction processes, and an environment that supports long-term asset security rather than speculative volatility.

The current currency environment allows buyers to be more selective. Where budgets may previously have limited options, Rand strength now enables investors to consider:

- Prime beachfront or lifestyle estate

- Larger homes or villas instead of smaller apartments

- Newer developments with stronger build quality and amenities

- Properties with better long-term rental demand and resale liquidity

This is not simply a question of timing the market, but of improving asset quality. Currency advantage allows investors to move up the value curve, acquiring properties that offer greater durability, stronger demand fundamentals, and improved downside protection.

Beyond pricing, Mauritius offers enduring structural advantages that continue to attract South African capital:

- No capital gains tax

- Desirable Lifestyle

- Tropical Climate

- No inheritance tax

- Consistent rental demand in prime locations

- A stable and predictable regulatory environment

- Recognised ownership schemes for foreign buyers

These factors support Mauritius property as both a lifestyle asset and a long-term wealth preservation tool, particularly in uncertain global conditions where real assets with strong fundamentals play an increasingly important role.

For South Africans evaluating offshore property, the current market represents a moment where currency dynamics and market fundamentals align. It offers the opportunity to lock in improved value, acquire better-located and higher-quality property, and future-proof investment decisions.

At Pam Golding Properties Mauritius, we guide buyers through every stage of the offshore acquisition process. Our teams identify properties that maximise value in US Dollar–priced markets, provide clarity around legal and regulatory requirements, and ensure each purchase aligns with long-term investment and lifestyle objectives. With deep experience across Southern Africa and Mauritius, we help translate currency opportunity into tangible property value.

For more information on the Mauritius Real Estate Market, contact projects@pamgolding.mu or whatsapp +230 263 4056.

Born in Mauritius, I have a Bachelor of Arts in Mass Communication. I have nearly 12 years’ experience in marketing, public relations and communications. Passionate about meeting people, creativity and business growth, I am results-oriented. My goal is to guide communication to touch the hearts and minds of customers. My motto is: “Treat others as I would like to be treated.”